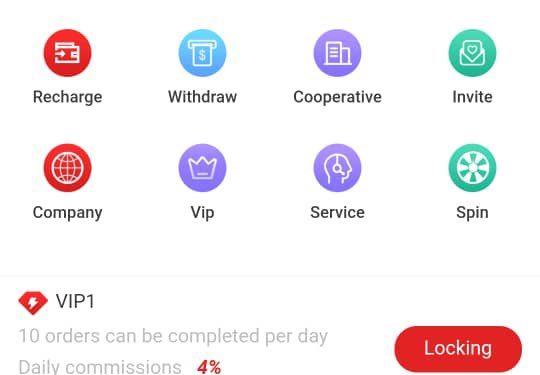

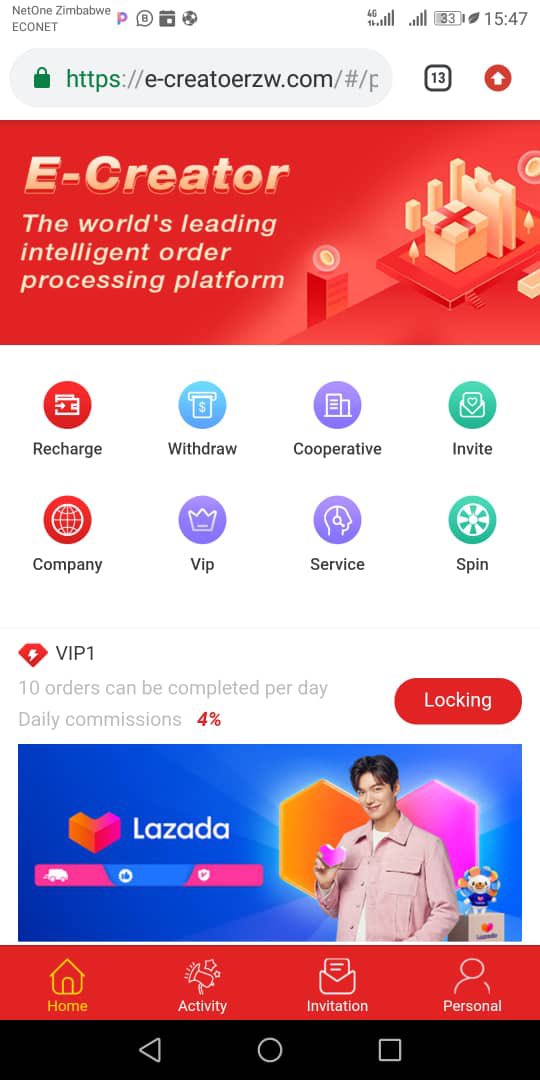

Young Zimbabweans have been warned against investing in a Ponzi scheme disguised as an online marketing business. The scheme, which has offices at Joina City is encouraging people to invest from USD 15 up to USD 100 for packages that gives them an opportunity to rate products.

Why E-Creator Zimbabwe is a Ponzi Scheme.

Staff at E-Creator Zimbabwe could not explain the reason behind depositing the money, if all what is required from their customers is to rate products.

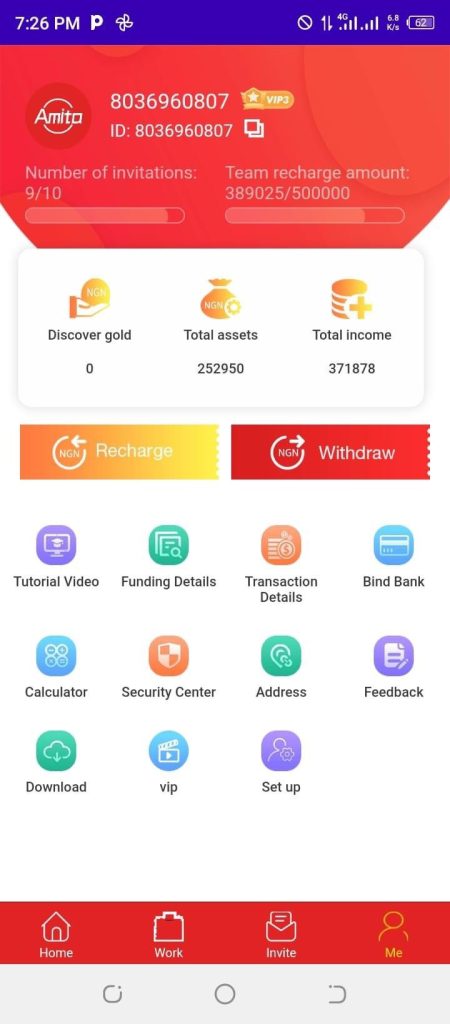

Apparently, an company called Amita E-commerce operated in Nigeria and swindled thousand, a close to similar platform is now operating in Zimbabwe with a new company name E-Creator.

The company poses as a multi level marketing business.

There is a new Ponzi scheme in Zimbabwe called E-Creator, They are posing as a Multi-Level Marketing company but we know where this will lead. pic.twitter.com/juVmLo5RoB

— ZimViral (@ZimViral) April 9, 2023

What is a Ponzi Scheme?

A Ponzi scheme is a form of fraud that lures investors and pays profits to earlier investors with funds from more recent investors. The scheme leads victims to believe that profits are coming from legitimate business activity (e.g., product sales or successful investments), and they remain unaware that other investors are the source of funds. A Ponzi scheme can maintain the illusion of a sustainable business as long as new investors contribute new funds, and as long as most of the investors do not demand full repayment and still believe in the non-existent assets they are purported to own.

The term “Ponzi scheme” was coined after a swindler named Charles Ponzi, who carried out this scheme in the 1920s based on the arbitrage of international reply coupons for postage stamps. However, similar schemes have been recorded as early as the 1860s by Adele Spitzeder in Germany and Sarah Howe in the United States. Some of the most notorious Ponzi schemes in US history include those orchestrated by Bernie Madoff, Allen Stanford, Scott Rothstein, Tom Petters and Robert Allen Stanford.

A Ponzi scheme is different from a pyramid scheme in that a Ponzi scheme claims to rely on some esoteric investment approach, and often attracts well-to-do investors, whereas pyramid schemes explicitly claim that new money will be the source of payout for the initial investments. A pyramid scheme typically collapses much faster because it requires exponential increases in participants to sustain it.